Why Us?

Developed by CPAs for CPAs

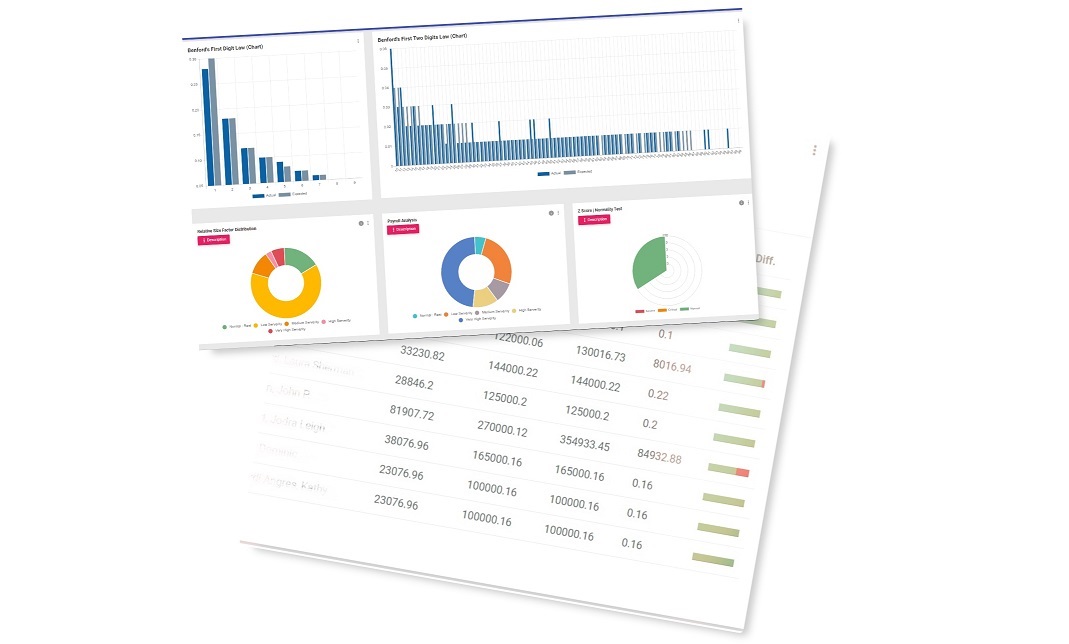

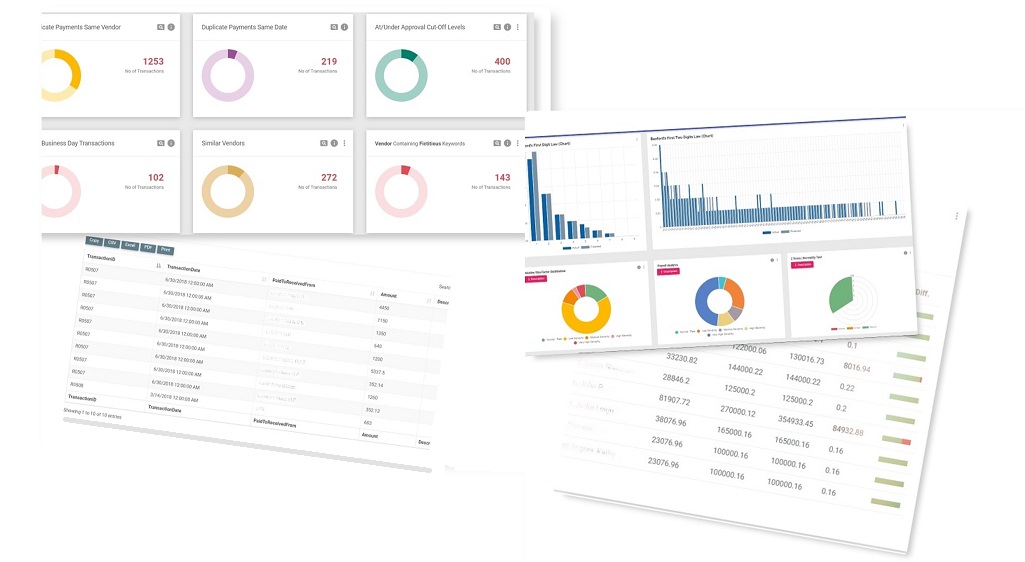

We have developed these employee, payroll, check, and accounts payable fraud tests with over 25 years of experience in public accounting and in public and private businesses dealing with internal controls and fraud. We are Controllers, CFOs, CPAs and internal auditors. Instead of pouring over thousands of lines of transactions, we load the data into our fraud analytics system and the tests are generated automatically.

Business Fraud

The median duration for all of fraud cases is 16 months and the longer a fraud goes undetected, the larger the scheme will grow.

Fraud can be especially devastating to small businesses. They lose almost twice as much per fraud scheme than larger companies. Data monitoring, analysis and surprise audits were correlated with the largest reductions in fraud loss and duration. Yet, only 37% of victim organizations implemented these controls.